(a) cash receipts from the sale of goods and the rendering of services. investors.Statement of Cash Flows)/Rect/Subj(Typewritten Text)/Subtype/FreeText/T(gmanahan)/Type/Annot>endobj66 0 objendobj67 0 obj/ProcSet>/Subtype/Form/Type/XObject>streamĮndstreamendobj68 0 objendobj69 0 objstream The cash flow indirect method provides a result more quickly and can also be used by people who have no insight into the company's business accounts, e.g.

#Cash flow statement indirect method solved examples software#

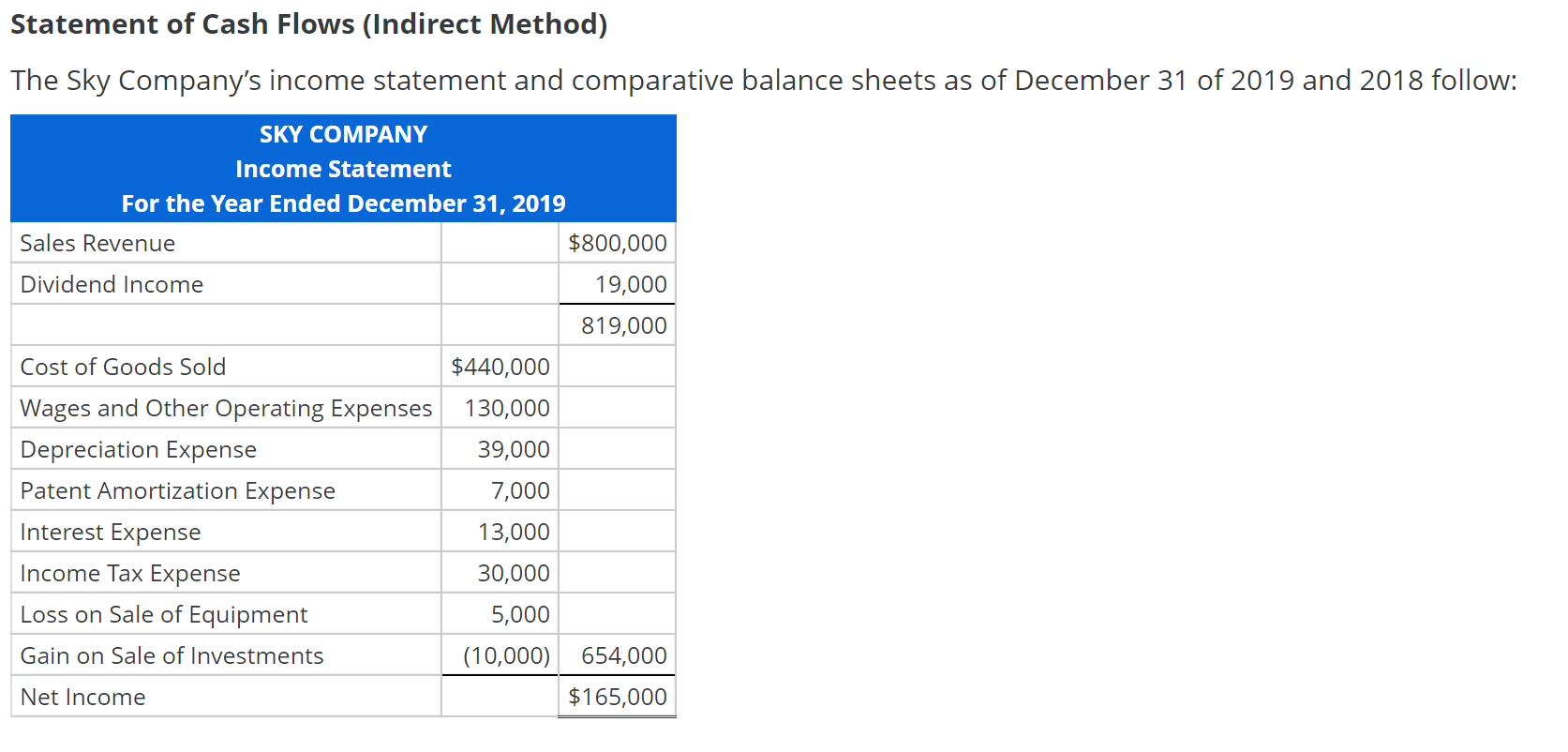

However, it is more time-consuming unless appropriate cash flow management software is used. The direct method is more accurate than the indirect method because it includes the actual cash flows in the calculation. To do this, it is necessary to look at the account transactions, because these represent the incoming and outgoing cash flows. This means that all income is compared with the expenditure for the period under consideration. In the direct method, on the other hand, the cash flow is calculated directly from the individual cash flows. All non-cash activities are then deducted from this. Net change in cash balance = Operating cash flow + investing cash flow + financing cash flow = £60,000 - £40,000 + £5,000 = £105,000Ĭash balance at end of period = Net change in cash balance + cash balance at start of period = £105,000 + £50,000 = £155,000 Cash flow indirct method vs direct methodĪs we have seen in the example, the starting point for calculating the cash flow with the indirect method is the turnover. Operating cash flow = Net income + depreciation and amortisation + accounts receivables + inventory + accounts payables = £100,000 + £10,000 - £60,000 + £30,000 - £20,0000 = £60,000 A company has the following item on its cash statement: Let's take a closer look at the formulas from the above section with an example. If you use the indirect method to calculate operating cash flow, you begin with your net income and then begin to add on depreciation and/or changes in. This result represents the cash flow at the end of the period under consideration and must now be offset against the initial value:Ĭash balance at end of period = Net change in cash balance + cash balance at start of period Cash Flow Indirect Method: Example Net change in cash balance = Operating cash flow + investing cash flow + financing cash flow Just as with the investing cash flow, the financing cash flow is determined from the cash statement:įinancing cash flow = Incoming financing cash flows - outgoing financing cash flows 4. Investing cash flow = Incoming investment cash flows - outgoing investment cash flows 3. The investing cash flow is all cash that has flowed within the scope of investment activities and can also be found in the cash statement: Operating cash flow = Net income + depreciation and amortisation + accounts receivables + inventory + accounts payables 2. Cash flow from operating activitiesįirst, one calculates the operating cash flow: The result is therefore exactly the cash flow that was generated within the period under consideration. In the indirect method, all activities that are not cash-based are deducted from the turnover. Financing activities: activities in which shares were issued or dividends distributed.Investing activities: activities in which assets were acquired or sold.Operating activities: All activities related to the production and distribution of a product.These are divided into the following areas: On the cash statement, the income and expenses during a certain period are summarised in categories. It is called the indirect method because the cash flows are not used directly for the calculation, but are determined from the turnover.

The cash flow indirect method is a way to calculate a company's cash flow from the data on the cash statement. We show you here how this method works and demonstrate it with an example. It is used both by companies for quick calculations and by investors who want to get an idea of the financial situation of a company.

The cash flow indirect method uses the information from the cash statement to calculate the cash flow within a certain period.

0 kommentar(er)

0 kommentar(er)